Blog Ecobraz Eigre

Return NF-e vs. destination: what is the correct tax flow to the CDF?

Understanding the Return Invoice

The Return Invoice (NF-e) is an essential document for recording the return of goods previously sold or transferred. Correctly completing and issuing this document guarantees fiscal control and avoids problems with the tax authorities. Returns can occur for different reasons, such as defects, order errors or dissatisfaction, and each situation requires specific attention as to the destination of the goods.

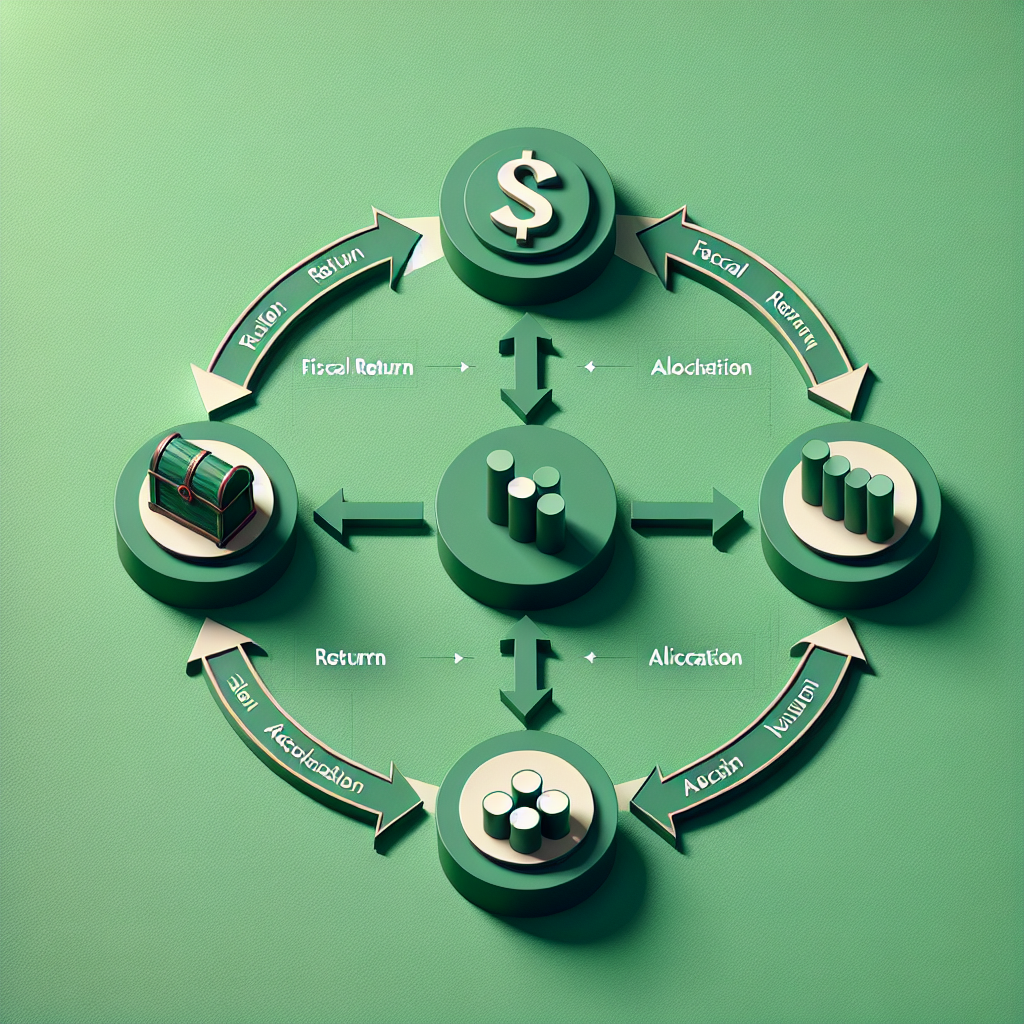

Fiscal Destination and the Role of the CDF

Once the return NF-e has been issued, the goods need to follow a fiscal flow that ensures their correct destination. The Tax Distribution Centre (CDF) plays a key role in this process, acting as the central point for receiving, checking and taxing returned goods. The CDF is responsible for checking, validating and directing the product to its next stage, whether it's reintegration into stock, return to the supplier or proper disposal.

Correct Tax Flow to the CDF

The process begins with the issuance of the return NF-e, which must contain precise information about the goods, the recipient, the sender and the reason for the return. Once issued, the goods are transported to the CDF. When it arrives, it is physically and documentally checked and entered into the CDF's tax system. If the goods are suitable for re-stocking, the flow will move on to internal inventory, with the corresponding invoices being generated.

On the other hand, if the destination is disposal or recycling, the CDF will arrange for specific invoices to be issued for these cases, such as NF-e for shipment for disposal or destruction. It is essential that this entire sequence is aligned with the legislation in force in order to avoid assessments or fines.

Documentation and Accessory Obligations

In addition to issuing the NF-e, other accessory obligations must be fulfilled, such as bookkeeping in the tax books, entry in the public digital bookkeeping system (SPED) and communication to the competent bodies when applicable. Product traceability throughout the flow, from return to destination, must be maintained to ensure transparency and tax compliance.

Care to Avoid Tax Problems

To ensure the correct flow of the return NF-e to the CDF, it is crucial to observe the rules for filling in the document, check the details of the recipient and sender, and follow the legal deadlines for issue and receipt. Logistics must be aligned with the tax process, avoiding delays that could lead to penalties. In addition, the tax team must be up to date on changes in legislation and practices recommended by the tax authorities.

Conclusion

The tax flow from the return NF-e to the CDF is a critical process that requires meticulous attention from the issuance of the document to the final destination of the goods. By following tax procedures correctly, keeping documentation up to date and observing legal deadlines and conditions, it is possible to guarantee compliance and efficiency in managing this type of operation.

Deixe um comentário

O seu endereço de e-mail não será publicado. Campos obrigatórios são marcados com *